Deductions with Tiered Matching

This release empowers payroll administrators to set up tiered retirement plan matches at both the company and employee level.

Overview

Namely now supports tiered retirement plan deductions, which makes managing complex employer matches for 401k plans including Safe Harbor and Automatic Enrollment easier. If you offer different employer matches based on your employee’s contributions, there’s no more need for manual calculations - our system can handle the work for you for two popular tiered plan structures.

Configuring a Current Deduction to have a Tiered Match

To begin leveraging a tiered match for your 40k plan, go to Namely Payroll > Company > Deductions, and click Edit next to your existing 401k deduction.

TIP:

Only retirement plans allow for a tiered deduction. All other deductions will retain the same Employer Cost functionality, with options for dollar or percent contributions.

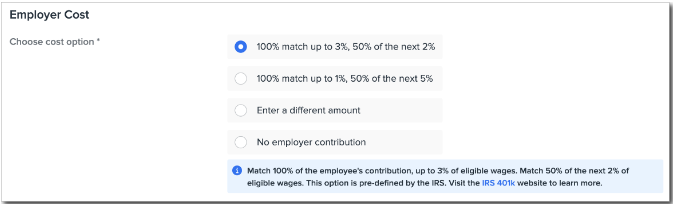

You can select from four Employer Cost options:

-

100% match up to 3%, 50% of the next 2%

-

100% match up to 1%, 50% of the next 5%

-

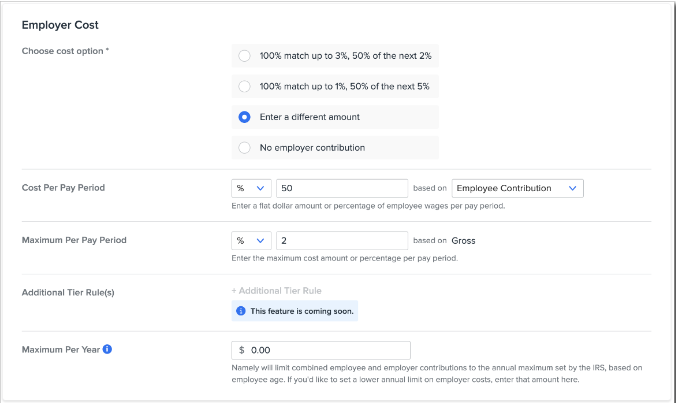

Enter a different amount

-

No employer contribution

If you’d like to enter a flat dollar or percent amount, or set annual or per-pay-period maximums, click Enter a different amount. In the future, you’ll also have the ability to configure different tiered structures than those detailed above.

TIP:

After selecting one of the tiered options, the Maximum Per Year field will lock and is hardcoded to display the combined limit with the IRS-mandated plan catch-up (currently $64,500). If you select Enter a different amount, you’ll be presented with the standard employer cost fields.

You can also add a new 401k deduction by clicking Add from your Deductions page. Follow the same steps detailed above to set up the tiered match.

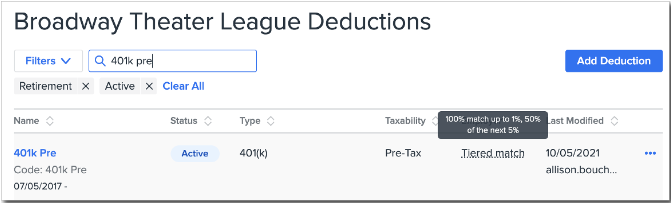

Identifying Company-Level Tiered 401k Matches

A tiered deduction can be identified directly on your company’s Deductions page. The Employer column will note that the deduction has a Tiered match, and you can view its tier rule by hovering over the notation.

Setting Up Tiered Deductions at the Employee Level

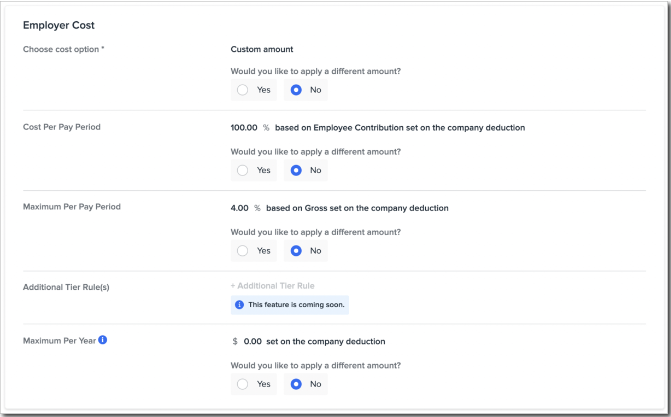

You can modify an employee’s existing 401k deduction to a tiered structure from the Deductions page on their payroll profile. This is only necessary if the desired employee deduction is different than the match set at the company level.

Click Edit next to the desired deduction, and scroll to the Employer Cost section. You’ll have the option to use the same tiered configuration from the company level, or you can set up different amounts if desired.

TIP:

If you set a custom Employer Cost or Cap Amount at the Employee level it will override the information from the Company level.

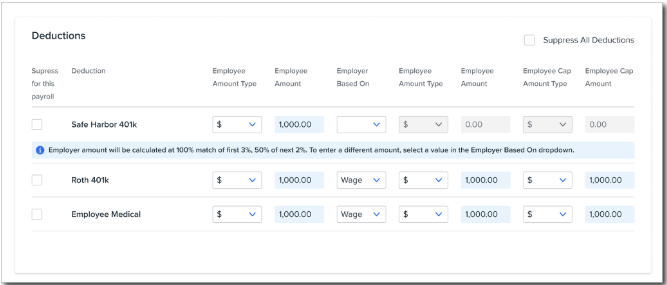

Step Two of Payroll Processing

You’ll notice that a banner appears under any tiered deduction indicating match details when editing an employee check on step two of payroll processing.

To edit a tiered deduction, you must first make a selection from the Employer Based On dropdown menu. Once a value is selected, all other fields will unlock and can be modified.

TIP:

Editing information in any of the last four columns will override the configured tiers.

Pay Cycle Imports

Any Employer Amount values entered via a pay cycle import will override your configured tiers.

Reporting

All deduction reports will now detail the

-

Deduction name

-

Tiered amount that was calculated in the pay period

-

Tiered amount that was deducted in the pay period

-

YTD deduction amount

TIP:

The Employee Deduction Report will not display the above information as part of this release but will be updated in the future.